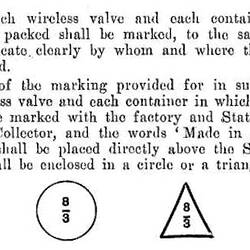

In 1936 'Wireless Valves' were added to the list of manufactured items that were subject to Excise. While subject to excise all valves manufactured in Australia had to be marked with a code showing the factory number and the state number. The circular form was the most common. The states were numbered from 1 for Western Australia to 5 for Queensland.

There were very few valve factories in Australia operating at the time that the Excise regulations were in force. Before the Second World War, Philips and AWV had factories in Sydney, but later Philips moved their valve manufacturing to Hendon, South Australia. STC also manufactured valves in Sydney but these were not sold to the public, they were only made for use in telephone and radio transmitting applications and did not appear to be subject to the excise requirements.

The only codes identified were:

1/4 Amalgamated Wireless Valve Company, Sydney 2/4 Philips Electrical Industries, Sydney (pre-war)

1/2 Philips Electrical Industries, Hendon (post-war)

In 1960 valves were removed from the list of items subject to excise and were replaced by cathode ray tubes. Receiving valves became subject to sales tax at that time.

References

Excise Regulations (Amendment) F1996B02968 (SR 1936 No. 99)

Excise Regulations (Amendment) F1996B03004 (SR 1960 No. 77)

More Information

-

Keywords

-

Authors

-

Article types