From 1883 to 1889 Melbourne witnessed an extraordinary boom in real estate prices and land speculation. By 1889, the value of land in parts of central Melbourne was as high as that in London. In central Melbourne, huge sums of money were poured into opulent new office buildings, many for the building societies, land banks and mortgage companies that were driving the boom. These gothic buildings came to characterise central Melbourne, especially Collins Street, until the 1960s.

The same speculators and financiers drove the expansion of the city at the edge, as market gardens and orchards were swallowed up for new housing developments. The new suburban estates spread along the expanding rail and tram lines; prospective buyers of land were lured with the offer of free railway passes and lunches of chicken and champagne prior to the auction.

The swathe of what are now middle suburbs were developed and consolidated during the 1880s, including Hawthorn, Camberwell and Box Hill in the east, Northcote and Brunswick in the north, Essendon and Footscray in the west and Brighton and Mentone in the south. Developers and estate agents promoted a suburban lifestyle that was embraced by both middle class and working class purchasers. (Mentone was named by the land speculators after a resort on the Italian Riviera).

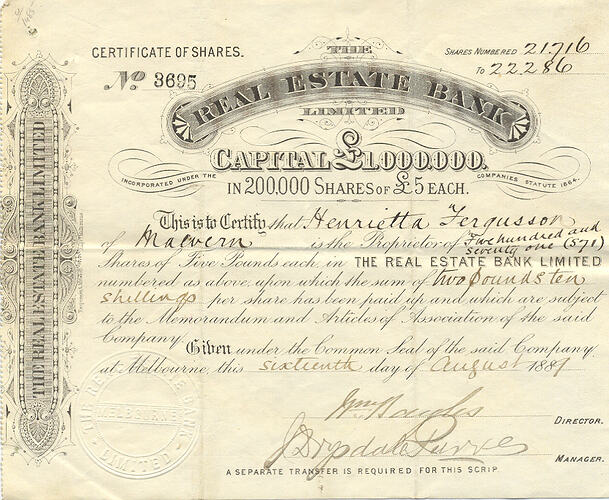

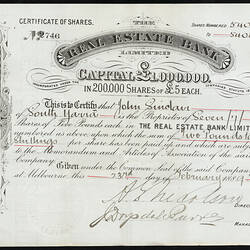

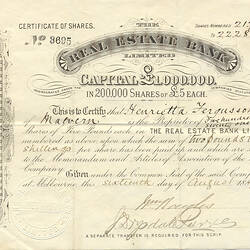

Many of the land boomers, as the entrepreneurs were known, were gold-rush immigrants who had started as labourers, started small businesses, then joined temperance leagues, savings banks and other working-class self-improvement societies in the 1880s. The most successful entrepreneurs developed an intricate web of land banks, mortgage companies, and building societies, many with complex cross-ownership and Byzantine financial arrangements. As long as confidence held, the boom kept growing, fuelled by speculation in land and shares in the companies.

But once growth slowed and confidence stalled, the boom collapsed into an economic depression that was the most severe faced by Melbourne at that time. Melbourne would take decades to recover.

The way in which the land boomers escaped their debts became as notorious as the dubious ways in which they had built their empires. Creditors were paid a small fraction of the sums they had invested, as little as a halfpenny in the pound (about one-fifth of a cent in the dollar). Many of these arrangements were made secretly and approved in the courts, enabling the boomer to escape the ignominy of bankruptcy and continue to operate other businesses that had been protected in the arrangements.

References:

Cannon, Michael (1966). The Land Boomers, Melbourne University Press, Melbourne.

Davison, Graeme (1978). The Rise and Fall of Marvellous Melbourne, Melbourne University Press, Melbourne.

More Information

-

Keywords

-

Authors

-

Article types